Transforming Sales and Marketing into a Unified Revenue Operations Powerhouse

In the rapidly evolving business landscape, the integration of sales, marketing, customer success, finance, and operations under the umbrella of Revenue Operations (RevOps) has become a strategic imperative for sustainable growth. The transition from traditional departmental silos to a cohesive RevOps model not only streamlines the revenue generation process but also fosters a culture of collaboration and data driven decision making. Here's how you can embark on this transformative journey.

Understanding the Need for RevOps

Before diving into the steps, it's essential to grasp the full scope of RevOps. Unlike traditional models that treat sales and marketing as discrete entities, RevOps is a holistic approach that aligns all revenue related functions. This alignment ensures a seamless customer journey from the first point of contact to post sale support, thereby maximizing growth and efficiency. Read more about what RevOps is here.

Step 1: Assessing Your Current Structure

Begin by conducting a thorough audit of your existing sales, marketing, and customer success departments. You must build an operational process document that completely spells out what these three departmental functions are doing on a daily basis. This includes the headcount and personnel composition of the department, the goals and financial objectives of the department, and the current KPIs by which the company is measuring them.

Once all of these departments are laid out in front of you so to speak you must then identify areas of overlap, inefficiencies, and misalignment. Understanding where you stand will help you map out a clear path towards this operation transformation.

Step 2: Defining Function Goals and Metrics

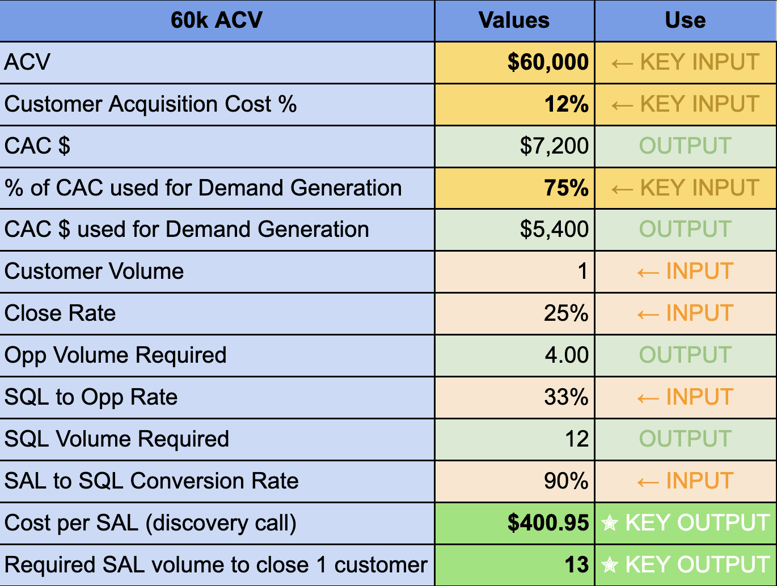

This stage is particularly exciting as it involves inviting the CFO to collaborate and reverse engineer the cost of acquisition metrics necessary for the organization to achieve its business goals. The ranges for these metrics vary greatly; for instance, early stage technology companies may accept a cost of acquisition at 250% of the first year's revenue, whereas manufacturing and industrial firms may aim for much lower single digit percentages. This variance largely depends on the organization's type and its financial objectives.

Once the target cost of acquisition and the expected lifetime value are determined with input from the CFO or the finance department, the organization can start setting its goals and objectives. The responsibility of meeting and surpassing the lifetime value, while ensuring high customer satisfaction levels, falls to the customer success team after the customer acquisition phase. Meanwhile, pipeline management is tasked with converting signed clients at a close rate above 15% and keeping the cost of acquisition at or below the company's required target.

It's time to delve into the intricacies of sixth grade algebra as we tackle the essential calculations for business success. Organizations must sift through the last three to six months of pipeline conversion data to pinpoint the investment needed to generate a Discovery (DISCO) call, successfully booked and held with your Ideal Customer Profile (ICP). This crucial stage, known as a Sales Accepted Lead (SAL), highlights the cost per SAL as a fundamental aspect of demand generation efforts. The goal for the demand generation department is to ensure that Discovery calls are booked and conducted with the ICP without exceeding the targeted cost.

Let's illustrate this concept with an example, focusing on the percentage of Customer Acquisition Cost (CAC) allocated to demand generation. This metric, often overlooked, varies significantly among organizations depending on the nature of their sales cycle—whether it's transactional or lengthy—and the resources required for effective pipeline management to close deals. A useful guideline is that organizations with transactional sales processes typically allocate less than 25% of their CAC to pipeline management. Conversely, a company with a sales cycle spanning three to nine months might spend between 50 to 60% of its CAC on pipeline management, reflecting the increased effort and resources needed to nurture and close deals.

In this example the demand generation team must deliver, through one of the four pillars of demand generation, a DISCO call booked and held with their ICP for $400.95 or less.

As long as each department meets or exceeds their financial goals, the organization is set for growth, showcasing a financially efficient and productive revenue operations process.

Step 3: Implementing Integrated Technology Platforms

Running a successful revenue operations framework hinges on the seamless integration of financial and operational data. This integration must be both fluid and interoperable to accurately reflect the financial and operational performance of each department. One platform that stands out in facilitating this marriage is HubSpot, which I find particularly effective as a revenue operations tool.

HubSpot began as one of the first marketing automation platforms, spearheading the inbound marketing revolution. Over time, it has expanded its offerings to include a comprehensive CRM system, a suite of outbound prospecting tools, a full fledged customer management and ticketing system, and even a payments processing engine. This evolution has positioned HubSpot as a robust platform for managing various facets of revenue operations.

However, it's worth noting that HubSpot has its limitations, particularly in its capacity to incorporate financial data directly. Despite this drawback, there are several methods to bridge this gap and ensure that financial information is effectively integrated into the operational workflow. This capability is critical for organizations aiming to maintain a comprehensive overview of their revenue operations process.

Other revenue operations technology stack product examples are…

- Marketo

- Salesforce Marketing Cloud

- Salesforce

- MS Dynamics

- Zendesk

- Monday.com

Technology plays a pivotal role in enabling RevOps and this may be one of the heaviest lifts in the entire process. If you need help, consider hiring a revenue operations company to help with your tech stack management.

Step 4: Aligning and Training Teams

Adopting a Revenue Operations (RevOps) model necessitates a significant cultural transformation within an organization. It's crucial to unite all teams under the common vision and objectives of the RevOps framework. Investing in training programs is essential to cultivate new skills and competencies that can bridge the gaps traditionally seen between departments. Promoting collaboration and open communication is key to nurturing a culture of innovation and continuous improvement.

Typically, teams quickly come to value the new organizational structure and its goals, appreciating the increased levels of autonomy, transparency, and accountability that the RevOps model brings to each function. This change eliminates the common scenario where sales blames marketing, and marketing blames sales, allowing everyone to focus on their work without interdepartmental conflicts.

It is important to pay close attention to the development of key performance indicators (KPIs) and reporting mechanisms. This ensures that teams involved in demand generation, pipeline management, and customer success are clearly informed about how their performance will be measured and financially rewarded. Providing weekly updates on these KPIs and financial targets is critical, especially during the first 30 to 60 days of implementing the new structure. Such regular communication helps to sharpen the organization's focus on their specific KPI segments, facilitating a smoother transition to the RevOps model.

Step 5: Establishing a Continuous Feedback Loop

Transitioning from a conventional sales and marketing framework to a unified Revenue Operations (RevOps) structure is bound to feel unfamiliar during the initial months. It's crucial to establish accessible, realtime channels for constructive feedback to enhance processes, communication, or outcomes. Like any organizational change, effective change management practices are essential.

This involves the necessity to over communicate consistently as a team. Ensuring open lines of communication and actively seeking input from team members will help smooth the transition, making it easier for everyone to adapt to the new operational model. This approach not only aids in identifying and addressing potential issues early on but also promotes a culture of continuous improvement and collaboration, which are key to the success of the RevOps framework.

Step 6: Measuring Success and Scaling

With the RevOps foundation established, it's crucial to measure success using key performance indicators (KPIs) that accurately reflect the health of your revenue operations. Below are my recommended KPIs for each department within a RevOps structure:

Demand Generation

- Cost per SAL (Sales Accepted Lead) per source

- Blended Cost per SAL (Core metric)

Pipeline Management

- Sales Accepted Lead to Sales Qualified Lead (SAL to SQL) conversion rate (%)

- SQL to Opportunity conversion rate (%)

- Opportunity Close Rate (%)

- Deal Cycle Duration (in days)

Customer Success

- Average Lifetime Value ($)

- Average Lifetime Duration (in months)

- NPS (Net Promoter Score) or Client Satisfaction Score

When is the right time to switch?

Transitioning to a RevOps model represents a strategic evolution beyond mere structural change, setting organizations on a path to sustainable growth within a competitive landscape. This shift encourages a culture of collaboration, harnesses technology effectively, and aligns efforts towards a unified revenue objective, enabling companies to achieve unprecedented efficiency and profitability.

The journey towards RevOps demands dedication, adaptability, and a readiness to embrace change. When undertaken with a thoughtful approach, this transition can elevate an organization, making it more agile, customer-focused, and growth-driven, whether it's a nascent startup or an established enterprise seeking to revitalize its sales and marketing outcomes for better financial functionality and consistent success.

If you want a partner to help you in this transition, schedule a free consultation.